How a Debt Management Plan Singapore Can Help You Achieve Financial Freedom

How a Debt Management Plan Singapore Can Help You Achieve Financial Freedom

Blog Article

Proven Approaches for Creating a Tailored Debt Administration Strategy to Attain Financial Freedom

In the mission for economic liberty, the significance of a well-crafted financial debt monitoring strategy can not be overemphasized. The journey towards achieving a debt-free life is a careful procedure that calls for mindful factor to consider and tactical planning. By executing tested techniques tailored to your distinct monetary circumstance, you can lead the way for a more secure and stable future. From evaluating your present monetary standing to setting achievable objectives and discovering loan consolidation alternatives, each action plays an essential role in guiding you towards your ultimate financial purposes. Nonetheless, the crucial lies not only in the initial solution of a strategy however also in the ongoing surveillance and needed modifications required to stay on course.

Examining Your Present Financial Circumstance

Assessing your existing financial standing is a crucial preliminary step in the direction of achieving long-lasting financial stability and liberty. By carrying out a comprehensive analysis of your income, obligations, expenditures, and assets, you can get a clear understanding of your general monetary wellness. Begin by compiling a breakdown of all your income sources, including earnings, financial investments, and any other incomes. Next off, track your month-to-month expenditures, categorizing them into vital (such as real estate, energies, and grocery stores) and non-essential (like eating out or subscription services) Recognizing your capital will certainly aid determine areas where you can possibly cut down and conserve.

Furthermore, it is vital to take stock of your assets, such as financial savings accounts, retired life funds, and property, along with any type of arrearages, consisting of credit scores card loans, mortgages, and balances. Calculating your internet worth by deducting your liabilities from your properties offers a photo of your monetary position. This detailed assessment establishes the foundation for developing a customized financial debt management strategy tailored to your details monetary conditions.

Setting Sensible Financial Debt Repayment Goals

To accomplish monetary flexibility, establishing useful financial obligation payment goals is necessary for people seeking to restore control of their financial resources. Setting realistic debt settlement objectives includes a calculated technique that thinks about both long-lasting and short-term financial targets.

When setting financial debt settlement objectives, it is important to be specific, quantifiable, possible, appropriate, and time-bound (SMART) For example, purpose to settle a certain quantity of financial obligation within a particular duration, such as minimizing bank card financial obligation by $5,000 within the next 6 months. Breaking down bigger objectives into smaller sized turning points can help track progress and preserve inspiration.

Additionally, consider readjusting your investing behaviors to designate even more funds towards debt settlement. Creating a spending plan that describes expenditures and earnings can highlight areas where savings can be made to accelerate debt payback. On a regular basis examining and changing your debt settlement objectives as needed will certainly make sure continued progression towards financial liberty.

Developing a Personalized Spending Plan Strategy

Exploring Financial Obligation Loan Consolidation Methods

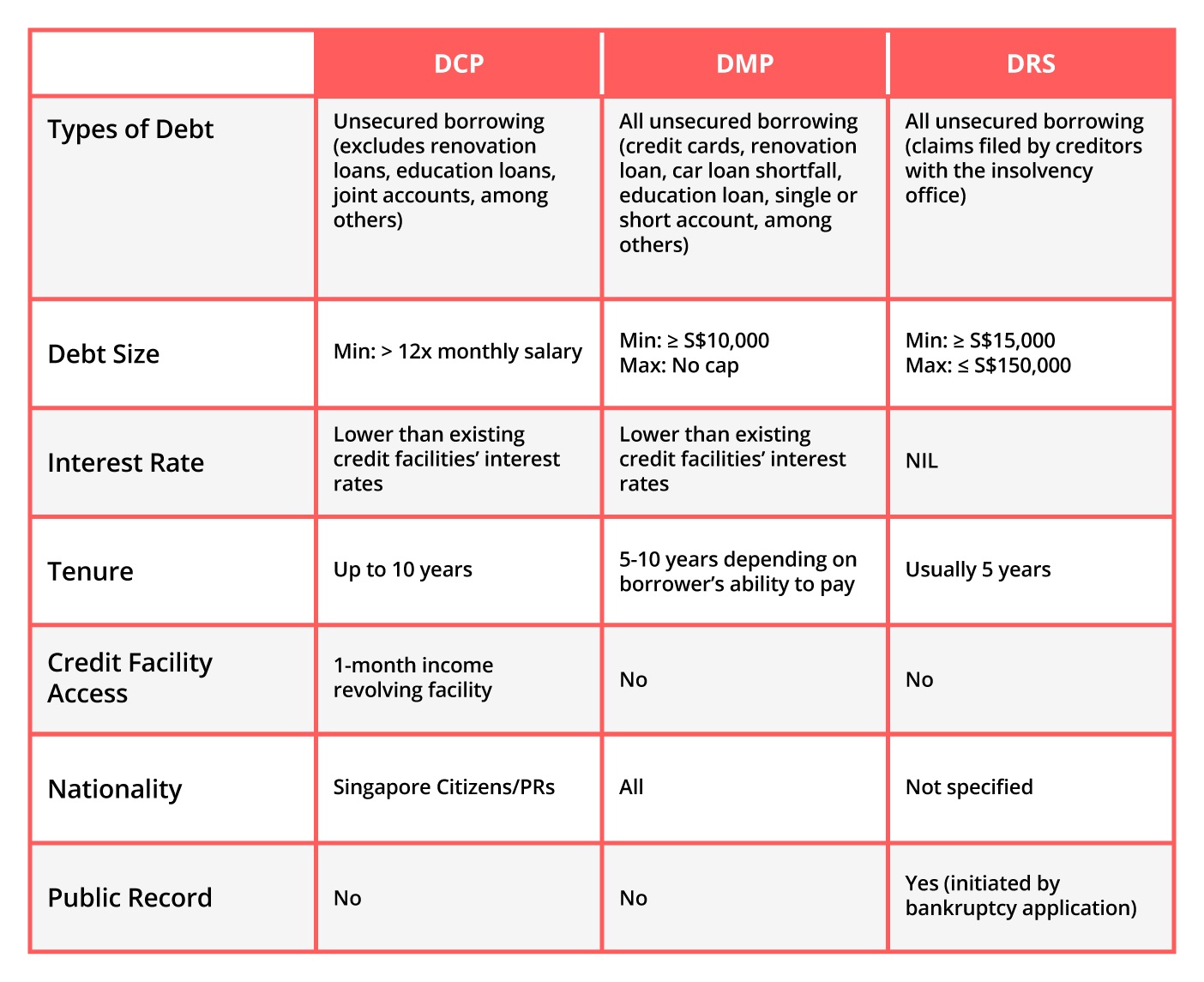

When thinking about financial debt combination methods, it is very important to assess the different choices readily available to determine the most appropriate technique for your financial scenarios. Financial debt debt consolidation entails incorporating numerous debts into a single funding or layaway plan, usually with a reduced passion price, to make it extra manageable to repay. One common approach is to get a combination funding from a monetary establishment to repay all existing financial debts, leaving just one month-to-month settlement to concentrate on.

Another strategy is financial debt monitoring with a debt counseling agency. These agencies collaborate with financial institutions to discuss lower rates of interest or month-to-month repayments on your behalf. debt management plan singapore. However, it's crucial to study and pick a reputable firm to prevent frauds or additional image source financial troubles

Checking out financial obligation loan consolidation approaches enables people to streamline their financial obligation settlement, potentially minimize passion costs, and work in the direction of financial flexibility.

Surveillance and Changing Your Strategy

Maintaining an alert eye on your financial obligation management technique is necessary for long-lasting financial success. Frequently monitoring your strategy enables you to track your development, determine any deviations from the initial method, and make needed modifications to stay on course towards attaining your monetary goals.

In enhancement to tracking, being aggressive in adjusting your plan is essential. Life circumstances, monetary top priorities, and unexpected expenditures can Resources all influence your financial obligation management approach. When confronted with changes, review your plan, assess the new variables, and adjust your technique accordingly. This adaptability guarantees that your financial debt administration strategy stays efficient and relevant in assisting you navigate in the direction of economic flexibility. Remember, a responsive and dynamic method to monitoring and readjusting your financial obligation management strategy is vital to long-term monetary security.

Verdict

To conclude, establishing a tailored financial debt monitoring plan is essential for accomplishing monetary flexibility. By analyzing your existing financial circumstance, establishing practical financial debt settlement objectives, developing a customized budget plan, exploring financial obligation loan consolidation strategies, and monitoring and adjusting your strategy as required, you can properly handle your financial debts and job towards a debt-free future. It is very important to prioritize monetary security and make notified choices to boost your total financial wellness.

In the mission for economic liberty, the significance of a well-crafted financial debt administration strategy can not be overemphasized. By adhering to a customized budget strategy, individuals can take control of their monetary circumstance, minimize financial i loved this debt, and progression towards financial freedom.

Keep in mind, a dynamic and receptive approach to surveillance and readjusting your debt management strategy is essential to long-term economic stability.

In final thought, developing a customized financial obligation management strategy is crucial for accomplishing monetary liberty. By examining your present financial scenario, setting reasonable financial debt settlement goals, creating a personalized budget strategy, checking out financial obligation consolidation approaches, and tracking and readjusting your plan as required, you can efficiently handle your debts and job towards a debt-free future.

Report this page